For years, pharma perfected the “next best message.” Predictive analytics elevates that to the next best moment — catching HCPs when they’re most receptive, spotting patients at risk before they slip, and routing support where it actually removes friction. When models are explainable and activation is disciplined, predictive turns busy omnichannel noise into timely, relevant, and compliant action.

Why Predictive, Why Now?

Commercial goals have shifted from impressions to impact: time-to-therapy, first-fill, and persistence now sit beside reach on dashboards. Rule-based journeys plateaued; probability-driven prioritization restores lift. Meanwhile, the stack matured — cloud data, feature stores, explainability libraries, and AI-ready CRMs (like Pulse Health) make it realistic to build, govern, and deploy without turning your program into a black box.

Three adoption guardrails keep everyone comfortable — especially MLR:

- Use explainable features and simple baselines where they perform well.

- Maintain consent lineage and purpose limitation for every feature.

- Run champion/challenger tests you can show (and defend).

What To Predict — for HCPs and Patients

For HCPs, start with adoption propensity to highlight likely initiators or up-titrators. Add content & channel affinity so the system knows whether a dosing one-pager, a short MOA video, or an RWE graphic will resonate — and on which channel.

When these signals feed call planning, reps see prioritized lists with a “why now” reason code and one-click assets.

For scientific dissemination and launches, network/diffusion models surface peer hubs who amplify appropriate use.

For patients, the highest ROI tends to come from three predictions: access friction (who needs PA coaching, copay support, or hub enrollment), adherence & persistence risk (first-fill and 30/60/90-day drop-off), and switch likelihood (cost, side-effects, convenience). A lighter-weight care-pathway gap model can nudge labs, follow-ups, or device training at the right time.

Quick-Glance Use-Case Matrix

| Audience | Prediction | Typical Features | Recommended Action |

| HCP | Adoption propensity | Panel mix, payer access, recent scientific engagement, peer influence | Rep visit; attach dosing + RWE; invite to peer webcast |

| HCP | Content & channel affinity | Past asset engagement, topic metadata, device/channel history | Auto-select topic/format; apply fatigue-aware frequency cap |

| Patient | First-fill risk | Plan rules, copay level, HCP, distance to pharmacy | SMS education + hub call; copay enrollment |

| Patient | 90-day persistence | Side-effect signals, refill cadence, de-identified socio-economic aggregates | Nurse outreach + education module; 3-day check-in |

| Access | PA approval probability | Plan rules, documentation completeness, diagnosis patterns | Route to PA specialist; send checklist; escalate if needed |

Activation happens inside Pulse Health CRM with role-based views for Reps, MSLs, and Hub teams.

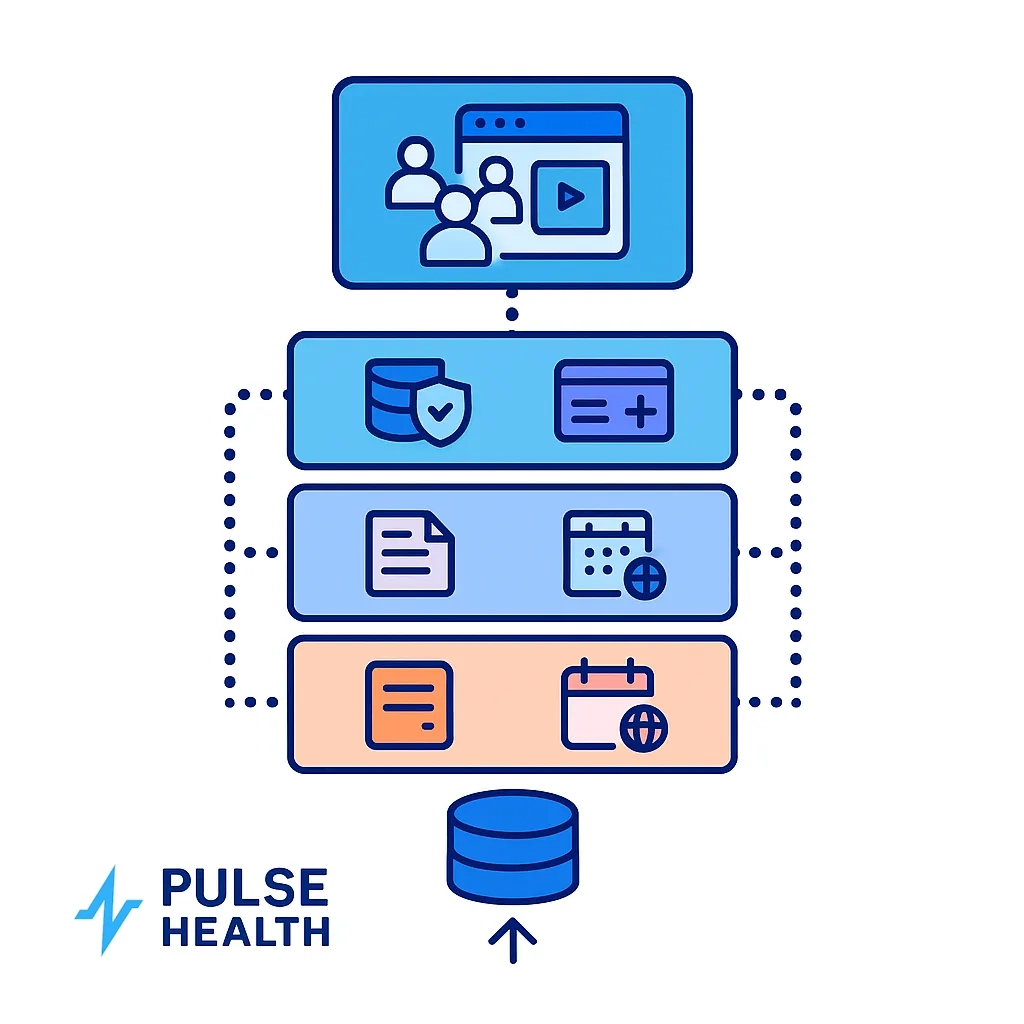

Data Foundation You Can Trust

A durable feature store blends consented first-party engagement (site journeys, eDetail events, email/SMS behavior, structured call notes) with de-identified claims/RWD (Rx events, diagnosis/procedure codes, permissible labs). Layer in payer and access (formulary tiers, step therapy, PA requirements, geography-specific copays), plus content metadata (topic taxonomy, scientific depth, label alignment) and external context (conference calendars, guideline updates, seasonality).

Keep governance productized, not perfunctory:

- Tokenized identity resolution; consent traceability attached to each feature.

- Data freshness SLAs and lineage from feature back to source.

- Bias checks and MLR-aligned taxonomies to keep models effective and auditable.

Modeling: Pragmatic First, Fancy Later

Start with high-signal, high-explainability baselines. Logistic regression and GLMs remain powerful for propensity and churn, especially when clinical intuition matters. Gradient-boosted trees (e.g., XGBoost, LightGBM) perform well on tabular healthcare data and pair nicely with SHAP to generate human-readable reason codes. For adherence and persistence, time-to-event or survival models map directly to refill hazards and treatment durability.

- Logistic/GLM for propensity and churn — transparent, clinical-intuition-friendly.

- Gradient-boosted trees (XGBoost/LightGBM) for strong tabular performance with SHAP reasons.

- Survival/time-to-event for persistence and refill hazards.

As programs mature, advanced approaches earn their keep. Graph ML can quantify network influence to prioritize KOLs and key peer hubs. Sequence models capture the order effects in journeys — say, content → rep call → script — so orchestration hits the right notes in the right sequence. Uplift modeling is particularly valuable because it predicts incremental impact from an intervention rather than mere correlation with outcomes, ensuring resources concentrate where they will change behavior.

- Graph ML to quantify network influence/KOL lift.

- Sequence models to capture “order effects” (content → rep call → script).

- Uplift modeling to predict incremental impact, not just correlation.

Model risk management should be routine: publish global and local explanations, monitor stability and drift, and rotate champion/challenger models each quarter to avoid complacency.

- Publish global/local explanations, monitor drift, and rotate champion/challenger quarterly.

Turning Scores into Actions (Where ROI Actually Appears)

Predictions should change behavior in one click. A rep view might show: “Why now: recent medical inquiry + panel fit + favorable access.” Buttons attach a pre-approved dosing sheet and an invite to a relevant peer webcast. An MSL view spotlights likely scientific questions and assembles compliant references. For patients, high first-fill risk can auto-trigger an educational SMS, a hub call, and a copay enrollment link; side-effect signals route to nurse outreach with a short follow-up check.

A few operating tips:

- Rank channels by predicted lift (rep visit, webcast, eDetail, email, SMS, in-app, hub call).

- Use fatigue-aware frequency caps and brief suppressions after sensitive interactions.

- Capture reason codes and outcomes so field feedback refines features.

Measurement: Proving Incremental Value

Causality beats hope. Territory or geo-split tests enable clean intent-to-treat reads; patient-level randomization shines for adherence programs; when RCTs aren’t feasible, synthetic controls offer disciplined pre/post comparisons. Readouts should bridge clinical and commercial KPIs:

- HCP: reach, engagement depth, adoption velocity, appropriate patient share.

- Patient: time-to-therapy, first-fill rate, PDC/MPR, 90/180-day persistence.

- Access: PA approvals, appeal success, cost-driven abandonment.

- Omnichannel: CPI-Rx (incremental) with stable or lower fatigue.

Roadmap (90–180 Days)

Phase 0 — Readiness (Weeks 0–4). Pick 1–2 high-impact use cases, inventory data and consent boundaries, baseline KPIs, and align with MLR/Privacy on tests.

Phase 1 — Pilot (Weeks 5–10). Ship HCP adoption and first-fill risk models; wire to Pulse Health CRM with reason codes; run a geo-split with frozen control.

Phase 2 — Scale (Weeks 11–18). Add uplift, extend to more brands/regions, automate refresh/monitoring/governance docs.

Phase 3 — Optimize (19+). Layer graph-based influence, personalize cadence by fatigue risk, deepen content-affinity.

Common Pitfalls (and the Fix)

Avoid the temptation to build a “mega-model.” Purpose-built models for adoption, access, and adherence tend to outperform and are easier to explain. Guard against overfitting to historical promotion patterns by rotating champion/challenger models and validating with causal designs. Prevent data leakage by time-boxing features and reviewing proxies that could encode protected attributes. Finally, don’t bury the “why.” If field teams can’t see the reason codes and the one-click asset that follows, predictions

- Mega-model syndrome. Purpose-built models outperform and are easier to approve.

- History bias. Don’t just learn past promo patterns — use champion/challenger and uplift validation.

- Data leakage. Time-box features and review proxies that smuggle protected attributes.

- Opaque UX. If reps can’t see the “why” and the next asset, nothing changes.

From “Next Best Message” to “Next Best Moment” — Powered by Pulse Health

Most pharma teams already run omnichannel programs: emails, eDetails, rep calls, webcasts, hub outreach. The bottleneck isn’t activity — it’s timing and relevance. Predictive analytics solves that by forecasting who will benefit from engagement, what to say, and when to act. But prediction without activation is just a dashboard. The lift shows up only when scores become clear, compliant next steps that field, medical, and hub teams can execute in one click.

This is where Pulse Health earns its keep. Pulse combines a privacy-first data foundation, explainable models, and a CRM built for healthcare workflows. We don’t force you into a black box; we help you ship pragmatic models quickly (propensity, access friction, adherence risk), wire them into role-based interfaces, and measure incremental impact with audit-ready governance.

In practice, that looks like:

- Data to features, safely. Consented first-party engagement + de-identified claims/RWD + payer/access feeds flow into a governed feature store with consent lineage, tokenization, and freshness SLAs.

- Explainable models. Baselines (GLM, gradient-boosted trees, survival) augmented with SHAP reason codes, so MLR and field can see why now.

- One-click activation. Scores render as prioritized lists with recommended assets and actions: rep visit + dosing/RWE, MSL evidence pack, hub PA support, patient SMS education.

- Closed-loop measurement. Geo/territory splits or patient-level tests feed KPI readouts — time-to-therapy, first-fill, PDC/MPR, PA approvals, CPI-Rx — so you can prove lift and scale with confidence.

Pulse doesn’t just predict; it operationalizes the next best moment across commercial, medical, and patient support — without compromising privacy or compliance.

How Pulse Health Turns Prediction into Measurable Lift

Predictive programs win when three things align: trustworthy data, explainable modeling, and frictionless execution. Pulse Health was built to align all three.

What you get with Pulse:

- Privacy-first data ops. Consent tracing, de-identification, feature lineage, and role-based access keep programs compliant and audit-ready.

- Models that make sense. Transparent baselines to start; optional uplift, sequence, and graph ML as you scale — always with reason codes for MLR and field.

- Activation that changes behavior. Rep and MSL views with “why now” context and one-click assets; patient and access workflows that trigger hub outreach, copay enrollment, and education at the right time.

- Proof, not promises. Built-in experimentation (geo splits, RCTs where feasible, synthetic controls when not) and KPI dashboards that emphasize incremental lift, not vanity metrics.

What it adds up to: Earlier interventions, fewer wasted touches, and clearer ROI — shorter time-to-therapy, higher first-fill and persistence, better PA outcomes, and lower CPI-Rx without spiking fatigue.

Next step: Book a Predictive Readiness Assessment with Pulse Health. We’ll identify two high-ROI use cases, map your data and consent boundaries, ship an explainable pilot within a quarter, and quantify the lift so you can scale with confidence.

Get the Pulse On Your Data

Ready to move from reactive to proactive?

Book a Predictive Readiness Assessment with Pulse Health.

We’ll pick two high-ROI use cases, map your data/consent boundaries, and stand up a measured pilot with defendable lift targets.

Frequently Asked Questions

Propensity is a subset. Mature programs also use survival, sequence, graph, and uplift models to optimize timing and incremental impact.

Honor consent and purpose limitation, minimize and de-identify data, separate promotional vs. scientific flows, and maintain model cards and lineage for audit.

Start with your best signals (first-party engagement + de-identified claims). Strong baselines and drift monitors handle imperfection; expand features iteratively.

Yes — with explainable features, versioned assets, clear testing plans, and documented governance. Engage them early.

Pilots typically show directional lift within 6–10 weeks; scale and uplift targeting compound ROI over subsequent quarters.